- #Quickbooks 2018 desktop with payroll how to#

- #Quickbooks 2018 desktop with payroll software#

- #Quickbooks 2018 desktop with payroll license#

- #Quickbooks 2018 desktop with payroll plus#

- #Quickbooks 2018 desktop with payroll professional#

#Quickbooks 2018 desktop with payroll software#

QuickBooks Desktop does not include customer service unless you purchase the software as an annual subscription.

#Quickbooks 2018 desktop with payroll professional#

QuickBooks Desktop has editions for construction, retail, professional services, manufacturing and wholesale, and nonprofit companies that include industry-specific reports and workflows.

#Quickbooks 2018 desktop with payroll plus#

The only mobile app available for Desktop is to capture receipts, and it requires a Plus subscription to Desktop.

QuickBooks Desktop is best for experienced bookkeepers in specialized industries who spend most of their time in an office and want a fast program that doesn’t depend on internet speed. QuickBooks Online is best for companies that need to give multiple people access to the program, including an outside accountant. QuickBooks Desktop must be installed on your computer, which offers faster navigation and data input, but a limited ability to share access. I'm always here to help.A key difference between QuickBooks Online and Desktop is that you can access QuickBooks Online from any computer or mobile device connected to the internet, and it’s easy to share data with your accountant. Please don't hesitate to leave a comment below if you have follow-up questions on how payroll works in QuickBooks Desktop.

#Quickbooks 2018 desktop with payroll how to#

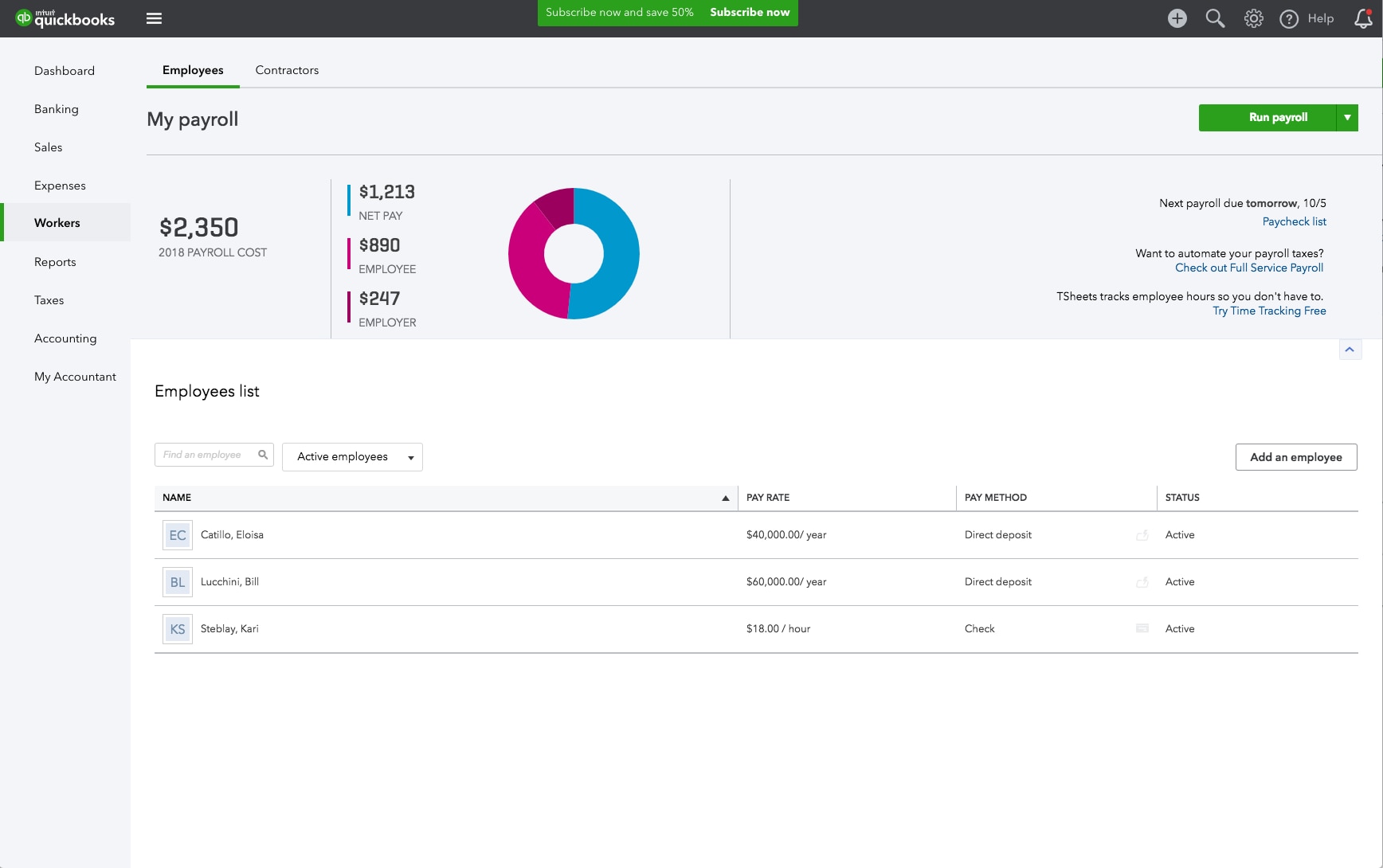

Lastly, here's how to add your employee's information: Follow the rest of the on-screen instruction to complete the setup process.Once activated, let's follow the steps below to set up your payroll and tax information.

#Quickbooks 2018 desktop with payroll license#

Enter your Payroll License and Product Information page.To activate payroll service in QuickBooks, here's how: Once you've activated payroll, you can proceed with adding each employee's information. I'm here to share with you additional information about the fee for every additional employee in QuickBooks Desktop Enhanced Payroll subscription.įor starters, if you have more than one employee, you'll have to pay $2 for every additional employee per month. Delighted to hear again from you, is designed to be a one-stop-shop for business owners to help achieve a better work/life balance.

0 kommentar(er)

0 kommentar(er)